NACCI Urges Implementation of Cabinet Decisions for Small Taxpayers in Assam

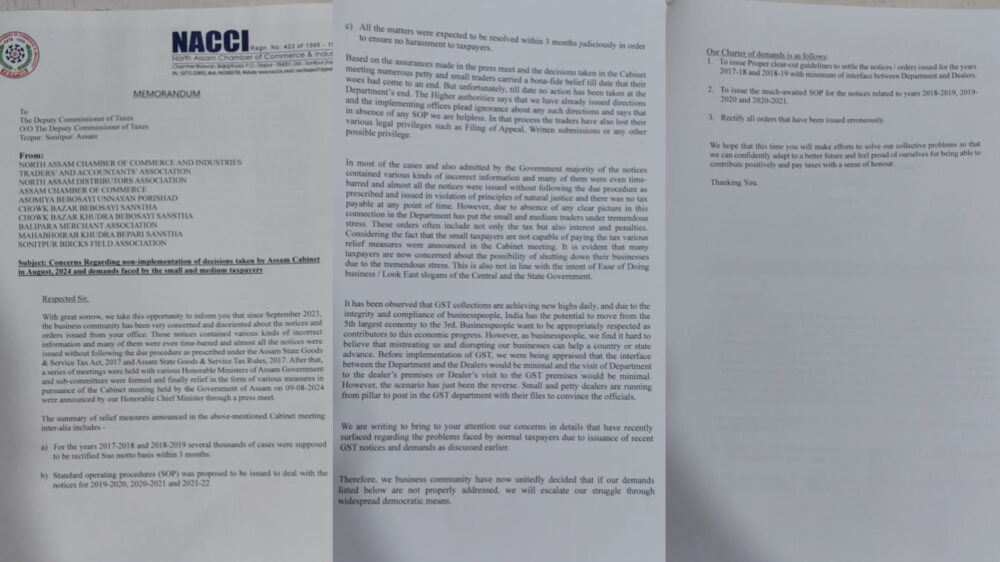

The North Assam Chamber of Commerce and Industry (NACCI) has raised serious concerns regarding the non-implementation of key relief measures that were decided upon during the Assam Cabinet meeting held on August 9, 2024. In a memorandum addressed to the Deputy Commissioner of Taxes, NACCI have highlighted their grievances over the continued issuance of incorrect tax notices and the lack of proper guidelines for resolving disputes.

Persistent Challenges Faced by Business Owners

Since September 2023, traders and small business owners have been dealing with an increasing number of tax-related notices that allegedly contain incorrect information. Many of these notices are reportedly time-barred and issued without adhering to the due procedures outlined in the Assam State Goods & Service Tax Act, 2017, and its corresponding rules.

Following discussions with the Assam Government and various sub-committees, a series of relief measures were announced in August 2024. However, despite assurances made in a press briefing by the Honorable Chief Minister, no concrete action has been taken to implement these relief measures.

Relief Measures That Remain Unimplemented

The Assam Cabinet had outlined several key measures to address the challenges faced by taxpayers, which included:

- Rectification of notices from 2017-18 and 2018-19: Thousands of cases were to be corrected on a voluntary basis within three months.

- Issuance of Standard Operating Procedures (SOPs): A structured SOP was supposed to be introduced to handle tax notices from the years 2019-2020, 2020-2021, and 2021-2022.

- Resolution of disputes within three months: Matters were to be resolved expeditiously to prevent unnecessary harassment of taxpayers.

Despite these decisions, traders claim that no meaningful steps have been taken by the tax authorities. While higher authorities state that directions have been issued, field officials claim ignorance due to the absence of an SOP, leaving traders in a state of confusion and distress.

Impact on Small and Medium Businesses

The memorandum highlights that these unresolved issues have placed small business owners under immense financial and mental stress. In several cases, taxpayers have lost crucial legal privileges, including the ability to file appeals or submit written explanations due to administrative delays. Moreover, the continued issuance of erroneous notices, often with penalties and interest, has further aggravated the situation, pushing many small traders to the brink of closure.

The traders argue that such actions contradict the government’s objectives of promoting the ‘Ease of Doing Business’ and the ‘Look East’ policies. Despite India’s rising GST collections and the country’s ambition to become the third-largest economy, the small business community feels neglected and mistreated.

Demands of the Business Community

In response to these grievances, the business community has unitedly decided to escalate their protest through democratic means if their demands are not met promptly. Their key demands include:

- Issuance of clear guidelines for resolving tax notices from 2017-18 and 2018-19 with minimal bureaucratic intervention.

- Immediate release of the pending SOP for notices related to 2018-2019, 2019-2020, and 2020-2021.

- Rectification of all orders that have been erroneously issued to ensure fair treatment of taxpayers.

The memorandum concludes with an appeal to the tax authorities to resolve these issues swiftly so that traders can operate with confidence and continue contributing to the economy with a sense of honor. The business community remains hopeful that their concerns will be addressed.